Liability Insurance

Liability insurance plays a crucial role in the life of business owners, professionals, and self-employed people, as it is designed to cover the cost of compensation claims that might arise due to injury, malpractice or negligence. The good news is it provides coverage against both legal costs and any pay out in case you are responsible and found legally liable.

Business Decisions & the Practices taken by the Companies have direct Impact on the Creditors, Shareholders, Regulator, Customers & even Employees also either way. These decisions or Practices can also leads Indemnity for Companies. Business liability insurance protects a Company, Business owner, Directors & Officers and their Employees in the event of a formal lawsuit or any third-party claim. Coverage includes any financial liability incurred in addition to expenses related to the company’s legal defence, these Policies are additional shield to cover such incidents for any businesses.

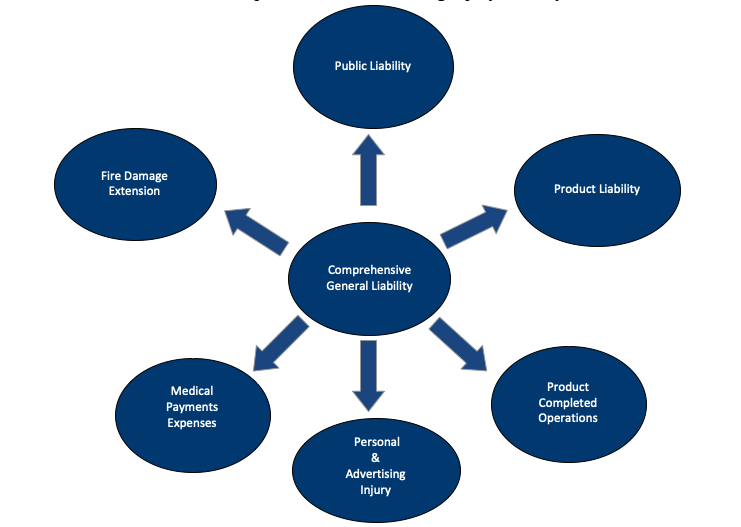

Commercial general liability (CGL) policy

As the name suggests this policy covers the risks that are common in business such as, property damage, personal injury and others that can arise due to unforeseen situations. It basically helps you to cover the amount that might incur due to out of court settlement, litigation and/or court judgments. This policy is very important for most of businesses or professionals, Specially where the footfall is more, like Showrooms, Restaurants Hotels, Hospitals, Super market, Offices, Manufacturing Unites etc. This Policy help you cover your company liability towards third party property bodily injuries or property damages, as the policy comes with both bodily cover and property damage coverage.

Insurance covering ‘Third Party’

- Bodily injury

- Property damage

- Limited Contractual liability

- Products and completed operations

- Also cover personal and advertising injury liability

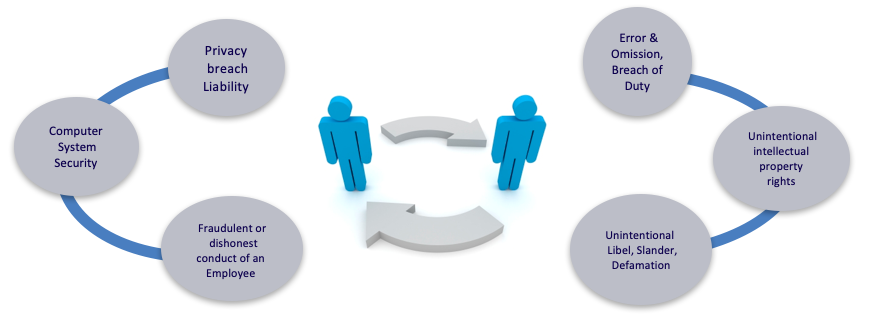

Professional Liability Insurance

Do these Terms Familiar you in the business?

Clients demand high standards of protection as a contractual condition, especially with overseas Clients. Handling Litigation or even contract dispute can be a time consuming and expensive experience when comes, Increasingly Professional Indemnity Insurance is a prerequisite when tendering for business specially with overseas companies. Professional Liability Insurance provides expert advice on complex claims situations, and assists companies in negotiating contracts.

What is Professional Indemnity Insurance ?

“The insurance covers Claims arising out of provision of professional services which are first made against the Insured, by a Third Party, during the Policy Period (or the Extended Reporting Period) and reported to the Insurer as required under the Policy”

Some of the Key Coverages in PI policy

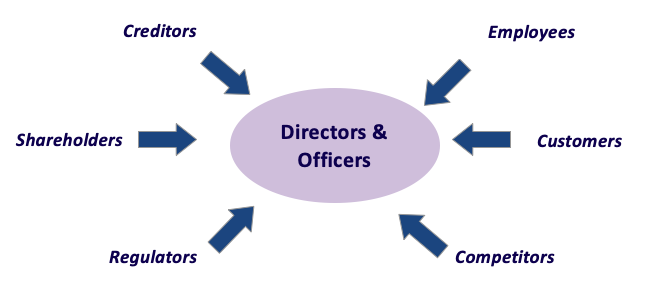

Directors and Officers liability insurance

A Company Directors are the People form the Group pf manages, who leads, supervise and guide the Company. He or She may be a individual who directs, controls or manages the affairs of the Company. Director person who is appointed to perform the duties and functions of a company in accordance with the provisions of The Company Act, 2013.

Directors are personally and financially liable for any negligent decision or action in the course of managing corporate affairs, any frivolous allegation can require engaging a lawyer to defend the claim and may incur huge defense cost to manage.

Who all can Sue the Directors & Officers

D&O Lability insurance policy shields Director & Officers

- Financial Damages due to the Decisions

- Multiple portion of multiple Damages

- Defense cost

- Pre and Post Judgment Interest

- Civil fines and Penalties

Investigation Costs

Cyber risk insurance

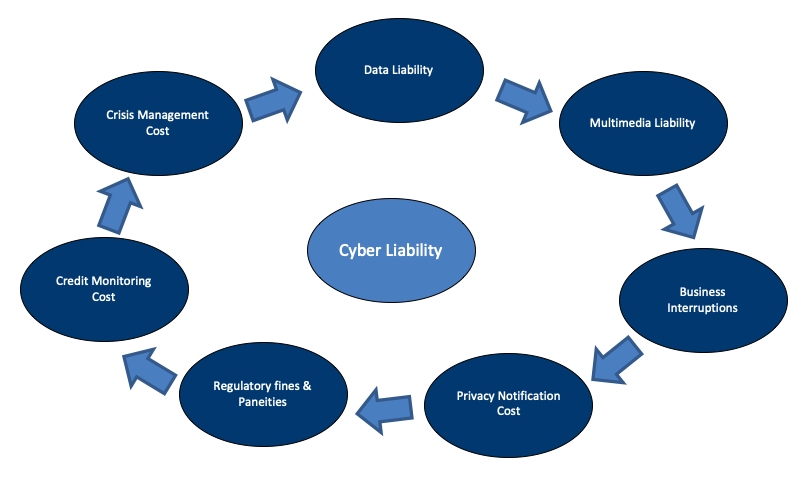

A cyber insurance policy is designed to help an organization or business to cover against the liability and property losses arising due to any electronic activity that the business engages in. This policy helps to offset the risk involved with recovery, after a cyber-related security breach.

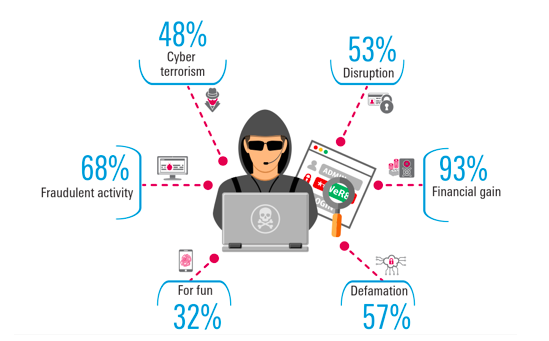

Motives of Cyber attacker (SOURCE: KPMG Cybercrime Survey Report, 2017 )

Policy Cover

How Coverdesk Works

Coverdesk is an Insurance advisory Consultants who helps you in the entire insurance journey right from decision making of which policy to take to final Claim Solutions.